Why address verification matters more than ever in the age of express checkout

Apple Pay. Google Pay. Link. PayPal. Klarna. Shop Pay. What do each of these payment methods have in common? In a nutshell, it’s their ability to simplify the online checkout process for online shoppers, sometimes down to a single click.

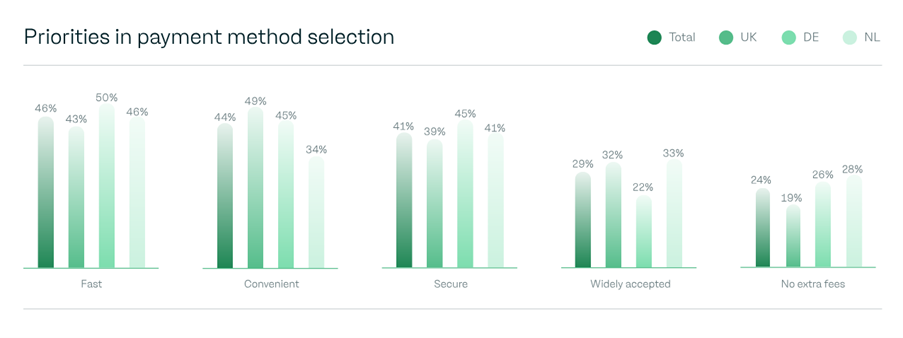

Express checkout is built for speed to enable fast, low-friction purchases, and is essential in reducing cart abandonment and enhancing mobile UX. DHL’s 2025 eCommerce report claims that 72% of respondents prefer to use digital wallets, while research carried out by Payabl highlights speed, convenience, and security as top priorities for customers when choosing an online payment method.

Apple has even focused part of its iOS 26 update around the Apple Wallet app, by introducing the capability to automatically scan emails and identify order tracking details sent by merchants or couriers.

Checkout flows in 2025 are not linear

Once upon a time, retailers had total control over their checkout forms and how customers entered their shipping addresses. Autocomplete solutions became hugely beneficial in improving address accuracy and enhancing overall UX.

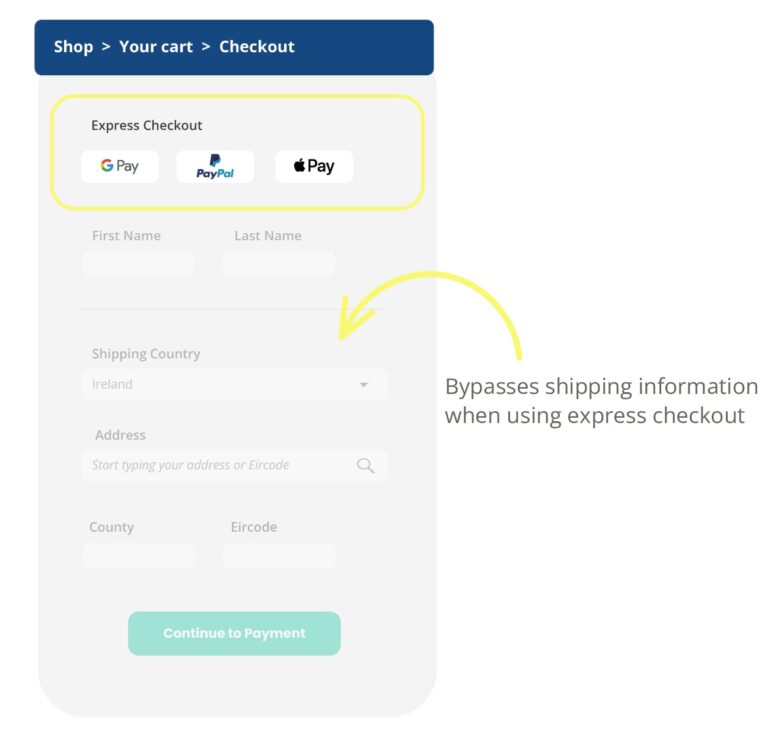

However, express checkout flows and digital wallets have added a layer of complexity by enabling customers to make purchases in as little as one click using personal information stored on various platforms.

This has resulted in major headaches for retailers, especially when it comes to address accuracy. Without verifying the final shipping address, every delivery carries the risk of delays, errors, and added costs.

Express checkout: great for UX but terrible for address quality

1. Incomplete wallet addresses

Addresses stored in digital wallets are often missing key details such as Eircodes and street names. Since payment providers prioritise billing over delivery information, these issues may go undetected unless you’re using some form of address verification (this is usually implemented after a failed delivery occurs).

2. Data overwriting and bypassed forms

Many digital wallets will bypass your checkout form entirely, replacing the address data with what’s stored on its own platform. This can override shipping form inputs and bypass important logic such as geofencing rules, resulting in shipments to unsupported regions, and additional admin resources spent resolving issues.

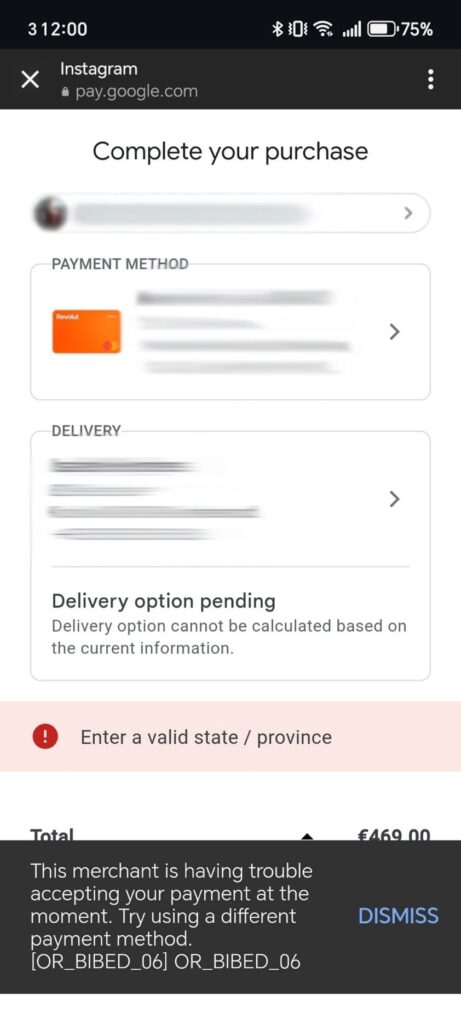

3. User friction and checkout failures

In some flows, the address returned by a digital wallet may not include all of required information on your form. This introduces confusion and friction for the customer, particularly if they are prompted to supplement missing fields. Disruption at this stage of the purchase can increase the risk of cart abandonment.

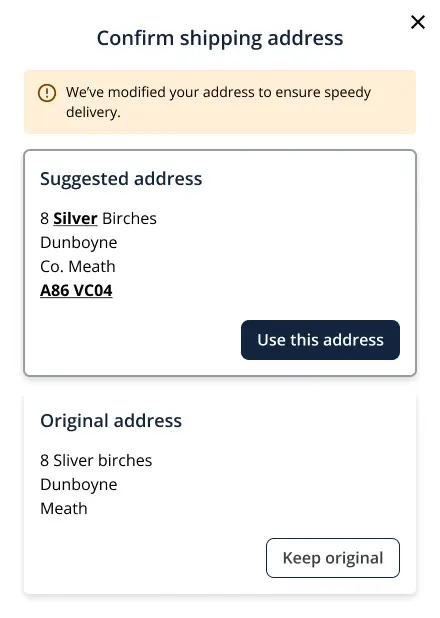

The above screenshot is an example of an attempted purchase directly from Instagram with shipping information taken from the user’s Meta Pay wallet. Three issues occurred:

1. The address associated with the payment method did not match the address associated with the delivery information.

2. The stored information in the Meta Wallet did not have all of the information required by the retailer on its own shipping form, and this mismatch caused an error when the information was passed back to the retailer’s form.

3. The purchase could not be completed until these issues were resolved, yet there was no easy way to rectify it.

4. No opportunity to verify

When the entire checkout experience takes place within a digital wallet’s interface, you don’t have a chance to verify the address before the order is confirmed, unless it’s handled after the transaction.

Both express checkout AND address verification is crucial

Getting deliveries right the first time isn’t optional anymore, it’s essential. Having an express checkout option is also critical, as the research above shows — checkout flows are less complex when digital wallets are used; customers want the convenience of a speedy checkout with no friction. If autocomplete solutions are known to increase order completions by 10%, think what could happen when you allow customers to complete a purchase in just one click!

So, rather than try to avoid the express checkout option and insist that customers use your form to fill in their address, let them bypass it and use the information stored in the digital wallet. If you implement address verification in tandem, it will ensure that the reduced friction at checkout doesn’t add any delivery problems.

Retailers that do not have a reliable address verification solution tend to face operational headaches such as failed and delayed deliveries, returns, and frustrated customers every day, often without realising how costly they are to the business.

How Autoaddress helps

Our address verify solution ensures that every address captured (whether via autocomplete, manually entered on the form, or chosen from a digital wallet), is verified, complete, and formatted for fulfillment. The benefits for retailers are significant:

- It works alongside existing autocomplete solutions

- It can integrate directly into your existing checkout or order management system

- It can easily validate addresses returned by digital wallets and other third-party apps

- It can help to ensure that geofencing and delivery zone rules are adhered to

Final thoughts

Retailers don’t need to control every detail of the checkout flow, but they do need confidence in the address data used when it comes to shipping their products. In a landscape where customer inputs, digital wallets, and automated systems can all influence the final shipping address, trust in that data is critical. That trust comes from verifying the addresses. Express checkout prioritises speed; address verification protects accuracy, reliability, and the customer experience.